Our Research

The Oxford University Economic Recovery Project (OUERP) shapes government policy and strategies to achieve net-zero emissions and sustainable development in the context of COVID-19 recovery efforts. We offer innovative evidence-based solutions and apply expertise in economics, finance, business and law. Emergency COVID-19 economic rescue packages have been designed and implemented around the world, totalling over USD 12 trillion across the 50 largest economies. In our May paper, we surveyed over 230 leading G20 economists, finding that well-designed clean spending – that which acts to reduce greenhouse gas emissions – could bring long-term environmental benefits without forsaking short-term economic value.

This section shows a selection of our published research. You can find a list of forthcoming white papers here.

in partnership with the Green Fiscal Policy Network (International Monetary Fund, United Nations Environment Program, and German Agency for International Cooperation)

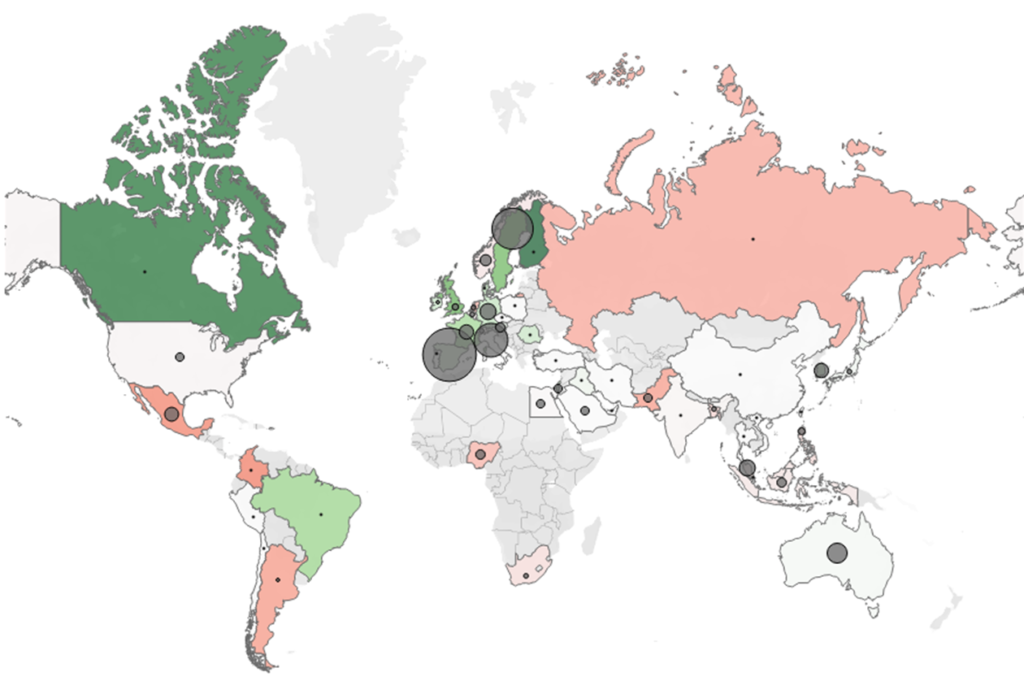

Governments are not reorienting their economies to a green future and vulnerable nations are being left behind.

COP26 has been anticipated as an inflection point in the fight against climate change. However, governments have so far failed to take advantage of their greatest ever fiscal opportunity on climate change—the COVID-19 economic recovery.

In this update, we present the latest data from the Global Recovery Observatory on global patterns in COVID-19 spending.

in partnership with Vivid Economics. Supported by the Children’s Investment Fund Foundation and the ClimateWorks Foundation

We introduce a handbook for policy makers and advocates to understand the phases of economic recovery and rationale for green investment at each phase. This handbook explores policy design, financing, and governance structures with key case studies in COVID-19 response for three nations with high reliance on coal-fired energy: India, China, and Poland. To better understand the economic, social, and environmental impacts of green investment compared to traditional and dirty investment, this handbook presents a series of modelling approaches that might be applied in any nation.

in partnership with the Green Fiscal Policy Network (International Monetary Fund, United Nations Environment Program, and German Agency for International Cooperation)

COVID-19 has led to a global crisis threatening the lives and livelihoods of the most vulnerable by increasing poverty, exacerbating inequalities, and damaging long-term economic growth prospects. The report, Are We Building Back Better? Evidence from 2020 and Pathways for Inclusive Green Recovery Spending, provides an analysis of over 3500 fiscal policies announced by leading economies in 2020 and calls for governments to invest more sustainably and tackle inequalities as they stimulate growth in the wake of the devastation wrought by the pandemic.

in partnership with the Green Fiscal Policy Network (International Monetary Fund, United Nations Environment Program, and German Agency for International Cooperation)

We introduce our work in progress methodology for tracking and assessing global COVID-19 fiscal policy in the Global Recovery Observatory. The document first introduces the Oxford Fiscal Policy Taxonomy, which includes 40 archetypes and 158 subarchetypes to categorise spending. Next, the document discusses the inherent and significant limitations of a priori policy assessment before establishing the evidence-based methodology of the Global Recovery Observatory.

Oxford Review of Economic Policy 36(S1)

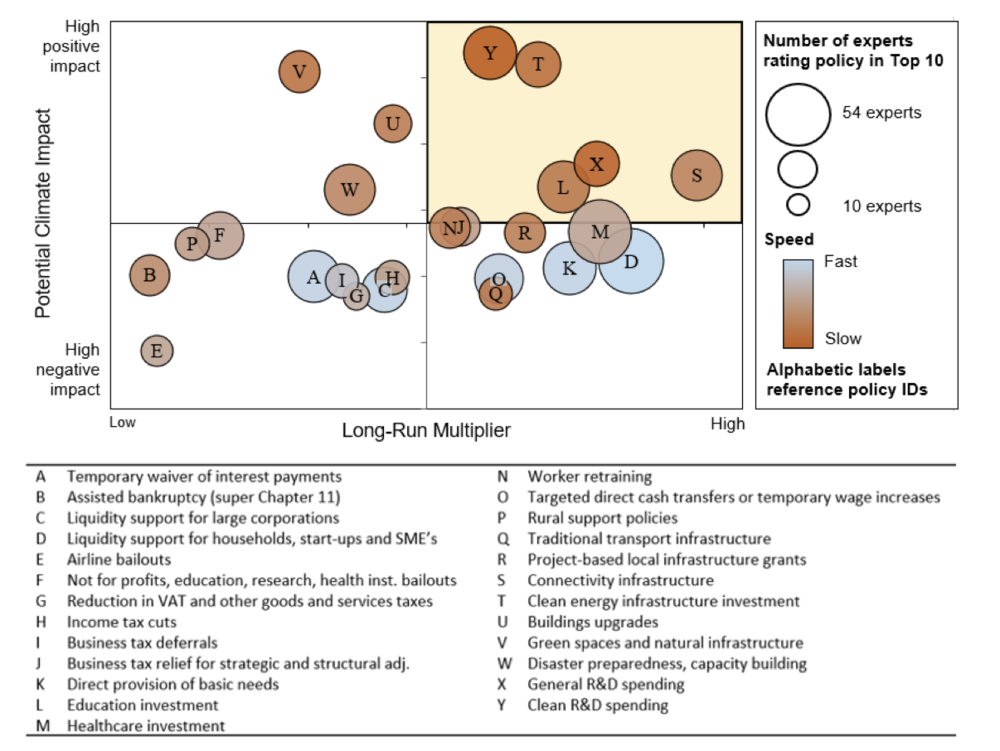

We survey 231 central bank officials, finance ministry officials, and other economic experts from G20 countries on the relative performance of 25 major fiscal recovery archetypes across four dimensions: speed of implementation, economic multiplier, climate impact potential, and overall desirability.

We identify five policies with high potential on both economic multiplier and climate impact metrics: clean physical infrastructure, building efficiency retrofits, investment in education and training, natural capital investment, and clean R&D. We conclude that green stimulus options have strong economic characteristics. Policy choices in the coming six months could drive a long-term downward trend in GHG emissions.

Submission to United Kingdom Environmental Audit Committee

Green jobs inquiry – 15 January 2020

We present five key points: (1) further investment into green jobs through larger programs of green investment can support the UK’s economic recovery from the COVID-19 pandemic, (2) the success of green programs like the Green Homes Grant is conditional on the availability of workers with appropriate skillsets, (3) the government should immediately undertake a skills assessment to identify capacity gaps and areas for labour force improvement, (4) green jobs can have positive impacts into the wider economy in the form of knowledge spillovers, and (5) bailouts to protect employment in high emission industries should come with green conditions attached.

A Green Recovery for Latin America and the Caribbean

Minimising the long-term economic impacts of COVID-19 by investing in green solutions

Following COVID-19, nations in Latin America and the Caribbean risk missing a once in a generation opportunity to reorient their economies for future growth, pull millions of people out of poverty, and simultaneously make progress against climate change and other environmental goals. This preliminary analysis of twelve Latin American and Caribbean countries shows that the region has made only small investments to economic recovery so far (USD51bn, which is 17.5% of total COVID-19 related spending), and almost no investments that meet climate-oriented recovery criteria (0.3%).

A Prosperous Green Recovery for South Africa

Could green investment bring short-term economic recovery while unlocking long-term sustainable growth?

Green spending could help South Africa address the COVID-19 economic downturn, reduce carbon emissions, and transition to a strong and resilient long-term growth pathway. Vivid Economics modelling suggests that investment in green initiatives could bring up to ~60% more jobs in the short-term and as much as ~140% greater economic value in the long-term, compared to traditional alternatives. Building on green aspirations contained in President Ramaphosa’s Economic Reconstruction and Recovery Plan, there is robust evidence to suggest that South Africa could use bold new green investment to swiftly create jobs, increase GDP, and improve social and environmental prosperity.

Green Economic Growth for the Democratic Republic of the Congo (EN) (FR)

How could post-covid green investment both bring short-term economic recovery and unlock long-term sustainable growth?

Modelling suggests that the Democratic Republic of the Congo (DRC) could benefit significantly from investments in green initiatives as a part of a COVID-19 recovery and advancement program. In response to the pandemic so far, the DRC has spent USD11 per person, only 0.05% of that spent on average in advanced economies (USD20,800 per person) and 1.6% of that spent in emerging market and developing economies (USD680 per person). This huge disparity has been driven not by policy inaction, in fact DRC policy makers have been industrious, but by limitations on fiscal space and international support.

Environmental and Resource Economics 76 (2020)

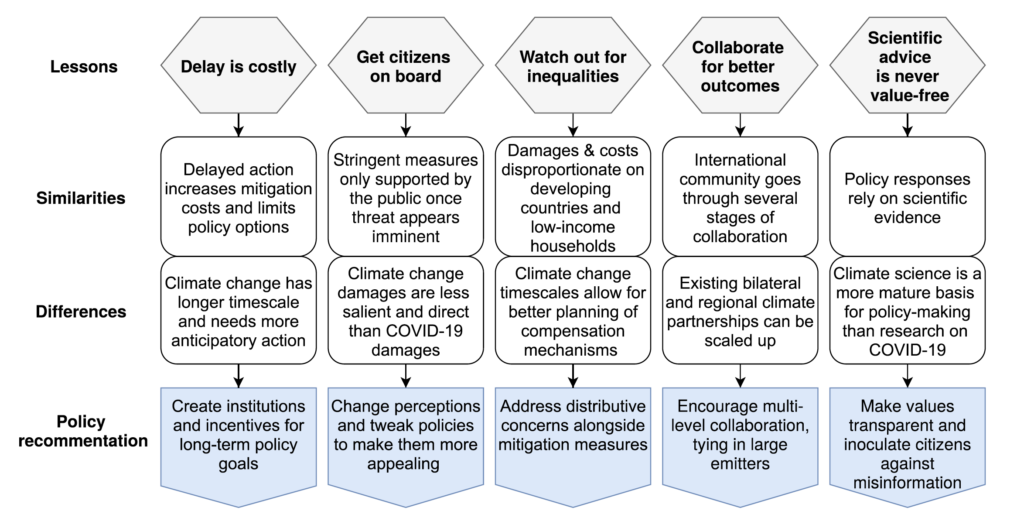

We take a holistic approach to the nexus of COVID-19 and climate change, making five broad comparisons between the crises with five associated lessons for climate change mitigation policy. First, delay is costly. Second, policy design must overcome biases to human judgment. Third, inequality can be exacerbated without timely action. Fourth, global problems require multiple forms of international cooperation. Fifth, transparency of normative positions is needed to navigate value judgments at the science-policy interface. Learning from policy challenges during the COVID-19 crisis could enhance efforts to reduce GHG emissions and prepare humanity for future crises.

COP26 Universities Network Briefing

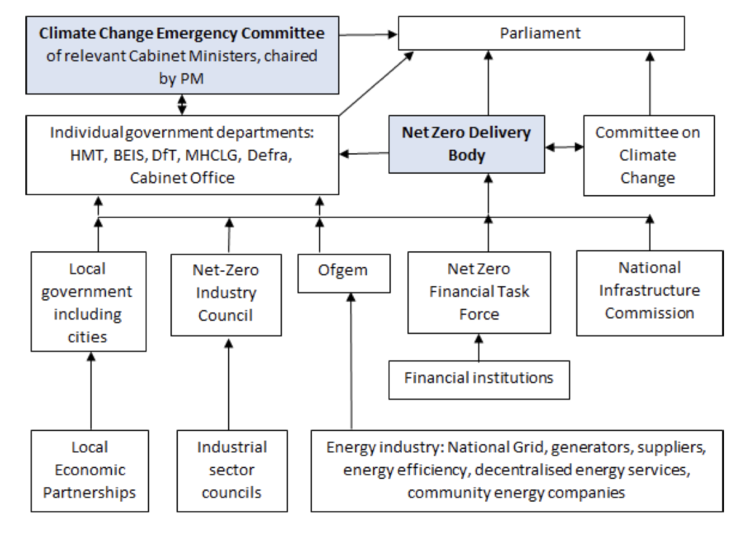

We identify ten fiscal recovery policies which could bring both short-term high economic impact and long-term structural change through decoupling greenhouse gas (GHG) emissions from economic growth. These policies would support the UK in meeting its legally binding commitment to net-zero emissions by 2050 while achieving wider social equality by ‘levelling up’ and addressing regional and intergenerational disparities.

Our background paper provides recommendations in four areas: (i) lessons from previous recovery packages; (ii) the appropriate evaluation framework for recovery packages; (iii) how the UK might lead by example through its own recovery; and (iv) how the UK might support other countries in the lead up to COP26 in 2021.

Submission to the Australian National COVID-19 Coordination Comission

We hypothesise that Australia’s unique natural resource endowment and industrial capacity profile could result in some of the highest economic multiplier and job multiplier figures amongst high-income nations.

With one of the world’s greatest endowments of renewable energy resources, the economic potential of green hydrogen in Australia is exceptionally strong. A commitment to enhanced grid infrastructure would unlock faster solar and wind new connection approvals. Our analysis also suggests that Australia is well placed to build competitive advantage in clean R&D, with a focus on demonstrator projects.

Submission to the House of Commons Standing Committee on Finance and the Senate National Finance Committee

Canadian economic growth has historically been reliant on fossil fuel-intensive industries – change is necessary and in Canada’s interest. A well-designed stimulus package is important to enabling economic recovery and targeting green industries could bring significant job growth as well as high economic multipliers.

In Canada, clean physical infrastructure investment could be directed to building new wind and solar electricity assets to complement existing hydroelectric generation. Investment in green hydrogen infrastructure could enable electricity storage and transport. Canada could also learn from programs it has implemented in the past to quickly direct capital towards insulation, building electrification, and smart home systems.

Oxford Smith School of Enterprise and the Environment Working Paper No. 20-05

We propose a series of measures that the Commission for Social and Economic Reconstruction could adopt to achieve a sustainable economic reconstruction. Spain has great potential to take advantage of EU recovery funds and the adoption of the proposed measures would position Spain in a preferential place to access them.

Our recommendations to guide direct investments focus on the development of a green and smart industrial policy, the renewal of the automotive sector, R&D of renewable energy, and the modernization of buildings and physical infrastructure to support the energy transition. Potential financial innovation measures should focus on attracting private investment and promoting the efficient use of public funds.

Smith School Briefing Paper 20-03

For governments targeting long-term prosperity, green hydrogen investment has been a central component of fiscal spending in the wake of COVID-19. So far, Germany has committed USD10.7bn (by 2030), France USD2.4bn (by 2022), and Korea USD0.5bn (by 2021). The EU has finalised a hydrogen strategy that expects investments of between USD3bn to USD18bn.

Green hydrogen fiscal investment can bring both strong positive economic impacts and strong positive climate impacts. The degree of impact depends, in large part, on the form of investment – R&D, infrastructure stimulus, or short-term provision of liquidity to existing green hydrogen corporations. Without a path to affordable green hydrogen there is currently no viable way of decarbonising a large portion of the global economy.

Oxford Smith School of Enterprise and the Environment & Vivid Economics Working Draft

We review fossil stimulus spending in four of the world’s largest coal producers. In China, many new coal-fired generation plants are already economically uncompetitive compared to renewable energy alternatives. Indian support for the coal sector manifests in market subsidies and in financing support for the operations and capital outlays of State-Owned Enterprises (SOEs). Further stimulus measures may shift forward existing plans for investment in coal-fired power generation.

In Poland, support of coal mining and generation enables the continued operation of otherwise loss-making enterprises. However, renewable energy generation is looking up and opportunities for renewable energy investment and nuclear energy investment have both received some discussion. While coal and oil still make up the vast majority of Indonesia’s electricity generation, recovery spending here has the potential to leverage considerable renewable energy resource endowments and establish new industries.